oklahoma franchise tax payment

Any taxpayer with an oklahoma franchise tax liability due and payable on or before july 1 2021 will be granted a waiver of any penalties andor interest for returns filed by august. Both C and S corporation s in Oklahoma pay a franchise tax levied on their business net worth.

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

All businesses and associations in Oklahoma are required to pay a Franchise tax.

. For every 1000 of investment 125 of tax is levied with a maximum limit of 20000 in a. Copyright 2007 Oklahoma Tax Commission Security Statement Privacy Statement Feedback OKgov Last Modified 10222007. The remittance of estimated franchise tax must be made on a tentative.

Many payers are small businesses and they have to pay on the total. When is franchise tax due. Time for Filing and Payment Information Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form 200-F has been filed.

Your session has expired. Once you have access to your Cigarette Wholesale account on OkTAP you can order stamps. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax.

The Oklahoma Corporation Commission says only corporations incorporated or formed in Oklahoma after July 1st 2013 must pay the franchise. Indicate this amount on line 13 of the Form 512 page 6. The maximum annual franchise tax is 2000000.

Who must pay franchise tax. Click the Order Cigarette Stamps link on the sidebar and complete the order form. Up to 25 cash back The franchise tax is assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital allocated invested or employed in.

A foreign taxable entity with no physical presence in Texas now has. The report and tax will be. The rate is 125 for each 1000 of capital you invest or use in Oklahoma.

While Oklahoma does have a franchise tax it only applies to corporations. Oklahoma Tax Commission Payment Center. Oklahoma Franchise Tax is due and payable July 1st of each year or if you elected to change your filing date to be the same as the date of filing your corporate income tax the report and tax will.

If filing a stand-alone OklahomaAnnual Franchise Tax Return Form 200 do not use this form to remit franchise tax. Oklahoma requires all corporations that do business in the state to pay a franchise tax. Corporations that remitted the maximum amount of franchise tax for the.

Limited liability companies are exempt from paying the Oklahoma Franchise Tax. For a corporation that has elected to change its filing period to match its fiscal year the franchise. The Comptrollers office has amended Rule 3586 Margin.

Oklahoma franchise tax is due and payable each year on July 1. With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives. We would like to show you a description here but the site wont allow us.

You will be automatically redirected to the home page or you may click below to return immediately. Nexus for franchise tax reports due on or after Jan.

Oklahoma Tax Commission Facebook

Oklahoma Income Tax Filing Dates Delayed Due To Covid 19 Mcafee Taft

Oklahoma Tax Commission Update You Now Have Until July 15 To File And Pay Your 2019 Oklahoma Income Tax Return View Our Webpage For Full Details Https Www Ok Gov Tax Covid 19 Information And Updates Html If There Are Any

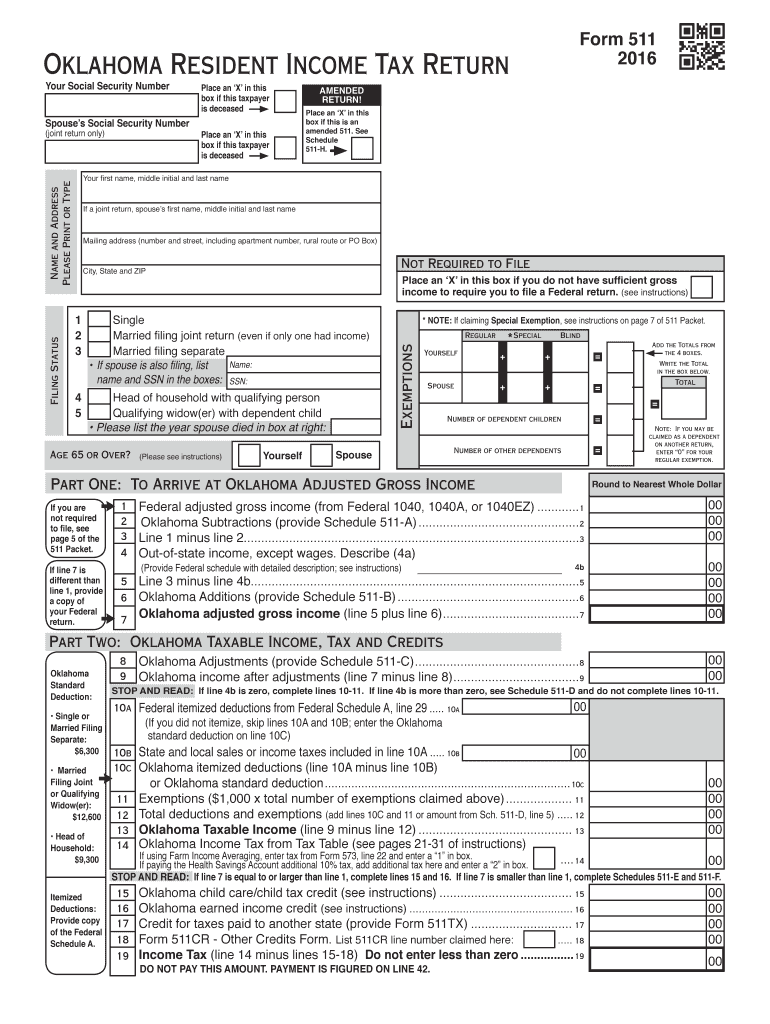

Ok Form 511 2014 Fill Out Tax Template Online Us Legal Forms

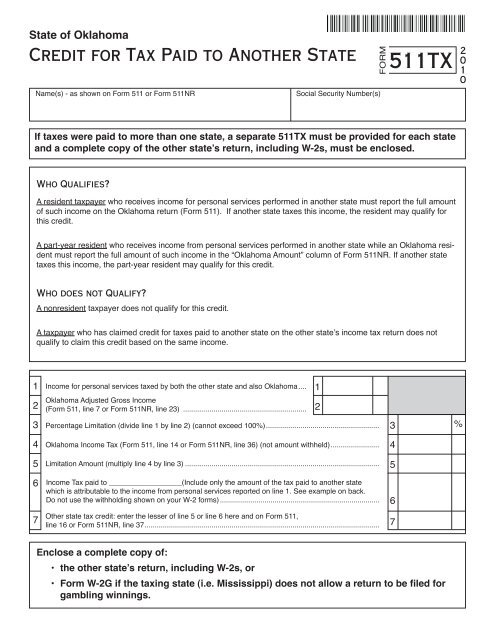

Form 511tx Oklahoma Tax Commission State Of Oklahoma

Lawmakers Voted Down A Corporate Income Tax Cut This Spring Leadership Should Leave It Out Of The Budget Oklahoma Policy Institute

Oklahoma Extends State Income Tax Deadline Until June 15 Local News Theadanews Com

Fillable Online Metrolibrary Print Oklahoma Tax Payment Voucher Form Fax Email Print Pdffiller

Oklahoma Individual Income Tax Declaration For Electronic Filing Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

State Individual Income Tax Rates And Brackets Tax Foundation

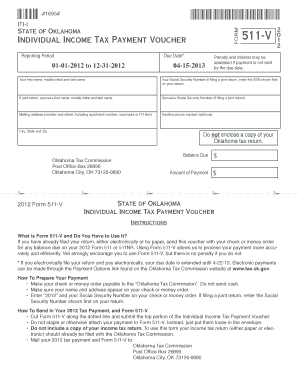

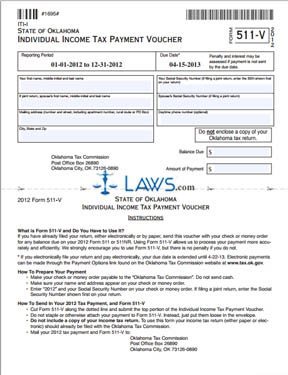

Free Form 511 V Income Tax Payment Voucher Free Legal Forms Laws Com

Want To Reduce Oklahoma S Public Services Hurt Local Business And Shrink Our Economy Eliminate The Corporate Income Tax Oklahoma Policy Institute

Oklahoma Tax Commission On Twitter The Oklahoma Tax Commission Has Extended The Deadline For Filing And Paying 2019 Oklahoma Income Tax Returns To July 15 Full Details At Our Covid19 Webpage Https T Co Iqr2ojvoa9

Oklahoma Tax Relief Information Larson Tax Relief

Ok2dr410 Oklahoma Income Tax Envelope With 2d Barcode Nelcosolutions Com

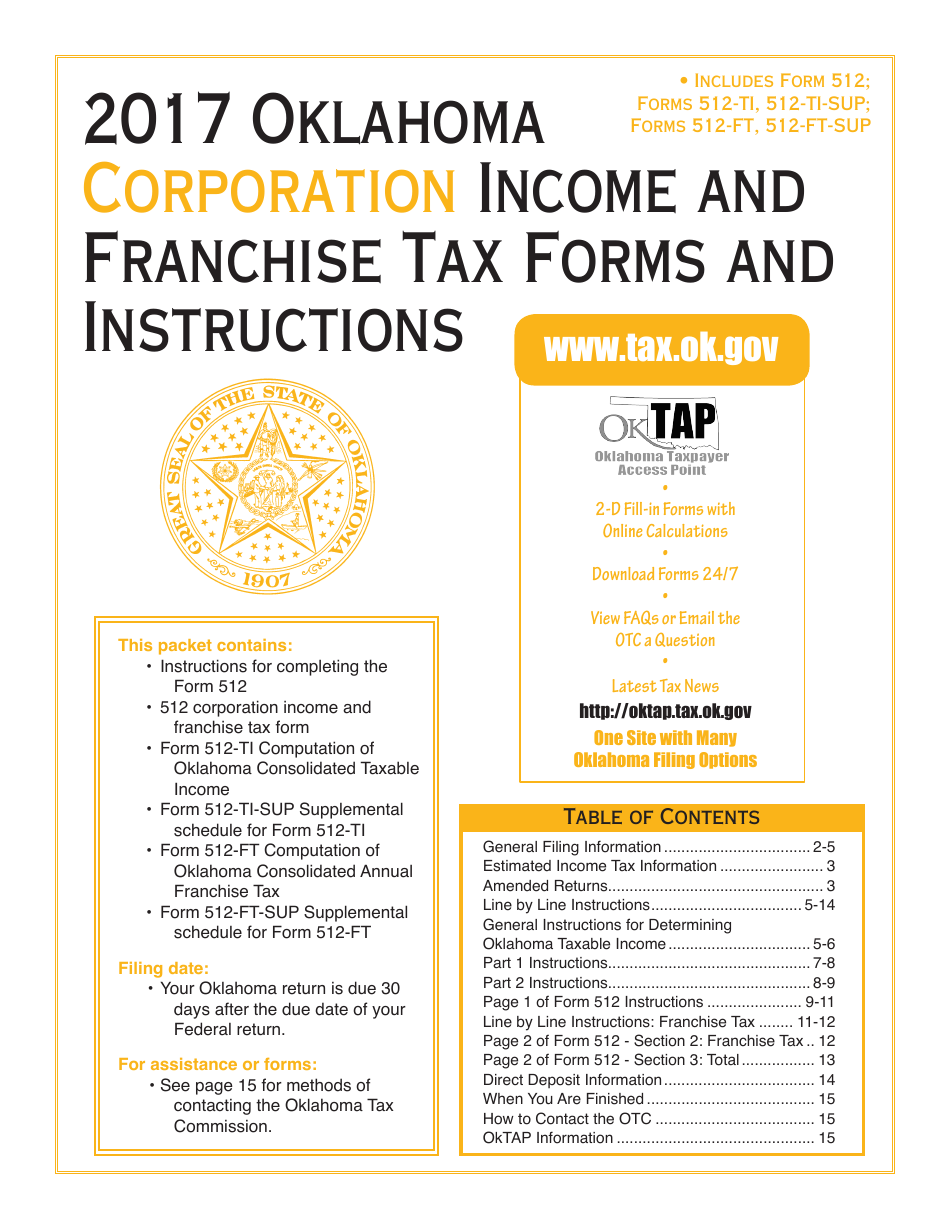

2017 Oklahoma Oklahoma Corporation Income And Franchise Tax Forms And Instructions Download Fillable Pdf Templateroller

Oklahoma Tax Rates Rankings Oklahoma State Taxes Tax Foundation

Oklahoma S Income Tax By The Numbers Oklahoma Council Of Public Affairs